What does residency by investment in funds mean?

Residency by investment in funds allows applicants to obtain a residence permit by placing capital into a fund approved by the host country. In return, the investor and their family members gain the right to live in that country.

Four European countries offer the fund route. The minimum required investment in each country is:

- Hungary — €250,000, invested in a government-approved fund[1]. This option offers one of the lowest entry thresholds in the European Union and is designed for those seeking a flexible and passive route through fund participation.

- Cyprus — €300,000, contributed to an investment fund recognised under the program. This route is part of the country’s permanent residency framework and suits applicants looking for long-term stability.

- Greece — €350,000, invested in a domestic investment fund. It is considered one of the more accessible options within the EU, combining moderate entry cost with established regulatory oversight.

- Portugal — €500,000, invested in a regulated investment fund[2]. Although the threshold is higher, the program is well-developed and offers a diversified fund market with professional management.

Some programs, such as the Cyprus Golden Visa, provide immediate permanent residency. Others, including the Hungary Guest Investor Program and the Portugal Golden Visa, issue a temporary residence permit that can lead to permanent residency and, later, citizenship.

Investing in funds is considered a passive and flexible route. It is often viewed as more liquid and simpler to manage, especially when compared with real estate purchases or business ownership, which may require greater involvement and bring additional expenses.

- Investment amounts

- Requirements for applicants

- Processing time and procedure

How do the Hungary and Portugal Golden Visas compare in terms of conditions?

Both Hungary and Portugal offer Golden Visas to non-EU nationals aged over 18 who hold a clean criminal record and a legitimate source of funds.

Establishing an address in the country

In Hungary, applicants must rent or buy residential property to register their address, although there is no minimum required amount for the property. Portugal does not require Golden Visa applicants to have a registered address in the country.

Processing times

Hungary offers the faster route, with residence permits typically issued within 5 months. Portugal, facing high demand and administrative backlogs, processes applications in at least 12 months.

Family inclusion

Both countries allow the main applicant to include their spouse, children, and parents. Spouses and parents can be included regardless of age, while the age limits for children differ slightly. In Hungary, children up to 25 may qualify; in Portugal, the limit is 26.

The investment amount remains the same whether the application covers only the investor or includes family members.

All adult dependents, apart from the spouse, must show financial reliance on the main applicant. In Hungary, parents can only rely on pension as their source of income, and adult children must be unmarried students. In Portugal, adult children must either live with the main applicant or be enrolled in higher education.

Validity of residence permits

Hungary issues a 10-year residence permit at once, with the option to extend it for a further 10 years. Portugal starts with a 2-year residence permit, which is then renewable.

Residence permits for adult children also differ. In Portugal, they receive permits matching the validity of the main applicant’s permit. In Hungary, adult children are issued permits for 3 years, which may be extended for the same period provided that children continue to meet the conditions: are financially dependent on the main applicant and study in university.

Stay requirements

Hungary does not impose any minimum stay requirement on Golden Visa holders. Portugal requires a short physical presence of at least 7 days per year to maintain residency.

Comparison of Hungary and Portugal Golden Visa fund investments

| Criteria | Hungary Golden Visa | Portugal Golden Visa |

| Minimum investment | €250,000 | €500,000 |

| Time to obtain residency | 5+ months | 12+ months |

| Eligible family members | Spouse, children under 25, parents | Spouse, children under 26, parents |

| Residence permit validity | 10 + 10 years | 2 years, can be extended an unlimited number of times |

| Minimum stay requirement | No requirement | 7 days per year |

What are the specifics of Golden Visa investment funds in Hungary and Portugal?

Not every investment fund in Hungary or Portugal qualifies for residency. Hungary licenses only those funds that invest at least 40% of their capital in domestic residential real estate and comply with national oversight. Portugal, by contrast, approves a wider range of funds, which are run by licensed management companies under the supervision of the securities regulator, with at least 60% of investments going to Portuguese businesses.

Eligibility of funds

In Hungary, a fund must receive a government licence to participate in the Golden Visa program. All licensed funds are listed on the National Bank of Hungary’s website. In Portugal, eligible funds are managed by licensed fund management companies registered and supervised by the Portuguese Securities Market Commission.

In both countries, approved funds must comply with EU rules, including Anti-Money Laundering and Know Your Customer requirements. Fund units must also have a minimum maturity of five years.

Minimum investment

In Hungary, the minimum contribution is €250,000. The Hungary Golden Visa does not allow the investment to be divided among several funds, so the full amount must be placed into one approved fund.

In Portugal, investors are allowed to split their overall investment across multiple funds. As a result, the minimum amount required for a subscription to a single fund can be lower than the overall €500,000 threshold. Depending on the fund, the minimum may range from €50,000 to €350,000. One exception is the Portugal Golden Opportunities Fund, where the minimum entry amount is just €1,000.

According to Olivia Morgan, an investment immigration expert, Hungary requires Golden Visa applicants to invest in a single licensed fund. This simplifies the process, as all Due Diligence checks, onboarding, documentation, and compliance procedures are completed once rather than repeated across several funds.

Hungarian funds follow a defined structure and strategy. At least 40% of the portfolio must be invested in Hungarian accommodation, particularly residential and student housing. The remaining assets are allocated to core or core-plus projects in the European Union, such as hospitality properties or distressed office buildings. Current projects include the Marriott Moxy Budapest Downtown, Deans College Hotel PBSA Budapest, and the Exchange Palace mixed-use development.

Fund options

In Hungary, the choice is currently limited. As of 2025, only two Hungary funds have been licensed:

- SPRINT Hungary Real Estate Development and Investment Fund.

- Gravitas Hungary Real Estate Fund.

Several other funds have submitted applications and are awaiting review.

In Portugal, the range is much broader, with more than thirty eligible funds. The list changes over time as some funds close subscriptions while others complete their investment cycles. Popular options include the Mercan Private Equity Fund, the Container Fund, and the Growth Blue Fund.

Olivia Morgan notes that, in Portugal, the minimum investment of €500,000 can be split across several eligible funds. Although diversification is allowed, our experience shows that investing in one or two funds — or at most three — is far more efficient. Handling multiple funds increases administrative work, including onboarding procedures, compliance checks, and document reviews for each fund.

Another important factor is the current backlog at the Agency for Integration, Migration, and Asylum in Portugal. Submitting a Golden Visa application with multiple funds can lead to additional information requests and longer processing times, potentially slowing down the process and increasing the risk of delays in approval.

Strategies and assets

In Hungary, the fund strategy is fixed in the fund’s documents. Each licensed fund allocates capital to Hungarian real estate projects such as residential buildings, logistics complexes, hotels, and office developments. The remaining assets are distributed across bonds, debt instruments, collective investment schemes, and derivatives.

In Portugal, strategies vary widely. Eligible funds may focus on sectors such as agriculture, renewable energy, technology, football management, or digital assets. Many invest in Portuguese companies or commercial real estate. However, Golden Visa rules forbid investment in residential property located in high-density urban areas.

Get our complete guide to explore the benefits, requirements, and application process for Hungary Golden Visa applicants.

Types of funds

Investment funds generally fall into two categories: closed-end and open-end. Closed-end funds issue a fixed number of units. These units can be traded on exchanges, and their market price may rise above or fall below the fund’s net asset value, or NAV. Open-end funds work differently. They issue and redeem units on an ongoing basis at their NAV, offer greater liquidity, and are not traded on exchanges.

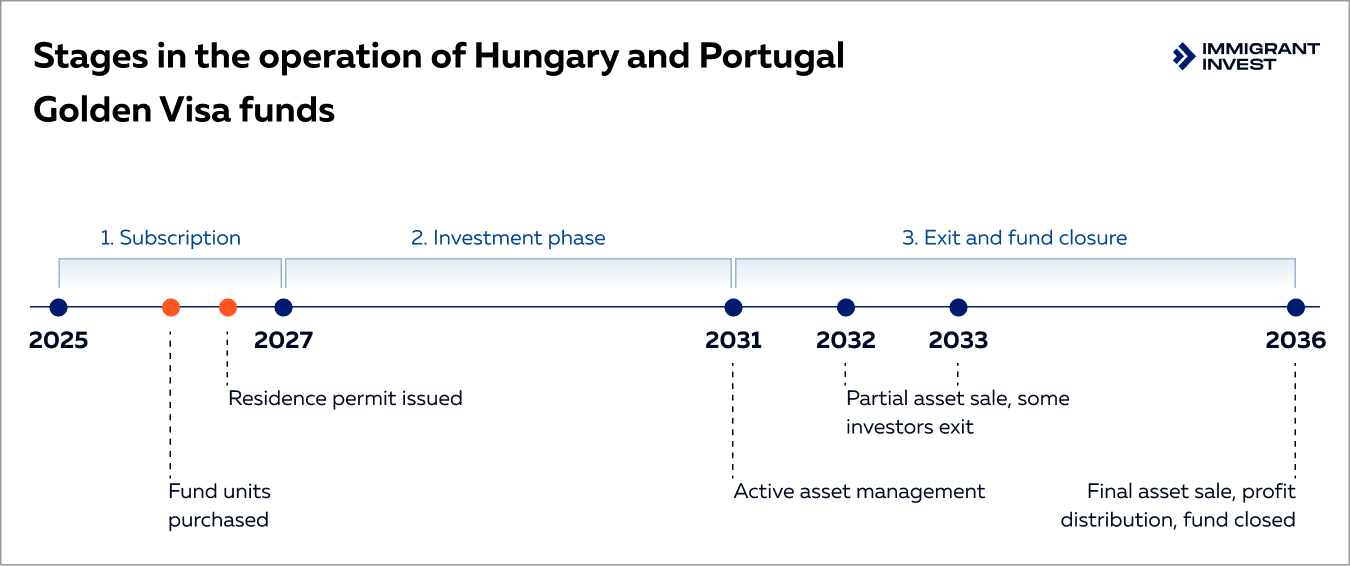

Most funds eligible under the Hungary and Portugal Golden Visa programs are closed-end. Such funds usually follow a defined cycle: they open for subscription, invest and manage assets, later divest, and eventually either close or restart a new cycle.

There are, however, a few open-end options as well. Examples include the Gravitas Hungary Real Estate Fund and the Portugal Golden Opportunities Fund.

Exit from investments

Both countries require investors to hold their fund units for at least five years. The actual exit, though, usually depends on the fund’s full cycle. Reimbursement can take anywhere from 6 to 20 years.

Selling units precisely after five years is typically only feasible with open-end funds, as they allow redemptions at NAV.

Units of closed-end funds may be sold before the end of the fund’s life cycle, but only if the investor finds a buyer. Because Golden Visa funds are niche investment products, their units tend to be illiquid, making resale difficult. Some funds do offer buyback options before the cycle ends, although these are generally at reduced prices.

Costs, taxes, and risks when investing in Golden Visa funds

Investing through a Golden Visa fund involves several types of fees. Hungarian and Portuguese funds both charge a subscription fee and an annual maintenance fee, and each residency by investment program includes administrative charges. Portugal also adds a performance fee linked to the fund’s returns.

Subscription and performance fee

In Hungary, the subscription fee typically ranges from €4,100 to 5,000. It covers onboarding, initial Due Diligence and the administrative work related to issuing fund units. In Portugal, this fee varies from 0 to 3.5% of the unit value.

Portugal is the only one of the two countries that charges a performance fee. This fee is taken from the fund’s profits and may be applied annually or quarterly. It usually ranges from 20 to 50% of the return.

Many funds use a hurdle rate, a minimum return the fund must exceed before a performance fee is charged, typically between 3.5 and 8%. If the fund does not outperform the hurdle rate, no performance fee is applied.

Annual maintenance fee

In Hungary, the fee usually falls between 2.5 and 4% of the fund unit’s value. In Portugal, the range is broader but generally lower, from 0.2 to 2.5%. In Portugal, both the subscription and maintenance fees are included in the fund unit cost, so investors do not pay them separately.

Administrative fee

Administrative fees also vary significantly. In Hungary, the administrative fee is €65,000 for a family of up to four people. Each additional dependant costs €10,000, and any dependant over 18 requires an extra €15,000, even within a family of four.

In Portugal, administrative fees are paid in two parts: €605 for processing the residency application and €6,045 for issuing the residence permit card.

Cost of obtaining a Hungary or Portugal Golden Visa through fund investment

| Investment | Subscription fee | Maintenance fee | Performance fee | Administrative fees | Total upon purchasing fund units | |

| Hungary Golden Visa | €250,000+ | €4,100—5,000 | 2.5—4% | Not charged | €65,000 for a family of up to 4 people + €10,000 per person, starting from the 5th + €15,000 per child aged 18 to 25 | €320,000+ |

| Portugal Golden Visa | €500,000+ | 0—3.5% | 0.2—2.5% | 20–50% of the return if the fund’s annual yield is above the 3.5–8% hurdle rate | €6,650 per family member | €506,650+ |

Yields and risks

The return an investor can expect from a fund depends on its risk profile. This profile is shaped by factors such as the type of assets the fund buys, the sector in which it operates, the experience of the management team, the liquidity of the assets, and broader economic conditions.

Funds are generally grouped into three risk categories:

- Low risk — well-established funds with a diversified portfolio, investments in stable or government-linked sectors, and a track record of more than five years;

- Medium risk — funds with moderate diversification, exposure to developing industries, newer management teams, and a history of three to five years;

- High risk — funds focusing on volatile sectors such as start-ups, with limited performance history, a narrow asset focus or lower transparency.

In Hungary, eligible Golden Visa funds fall within the low-risk category, so annual yields are generally not expected to exceed 6%.

In Portugal, eligible funds span all three risk levels. Expected annual returns range from around 2% for low-risk funds to up to 20% for high-risk strategies.

Taxes

Golden Visa investors must pay tax on income generated from their fund investments. In Hungary, investment income is taxed at a flat rate of 15 %. Non-tax residents must also pay an additional 13% charge.

In Portugal, tax residents pay progressive rates ranging from 13 to 48% on investment income. Non-tax residents are exempt from this tax.

Hungary and Portugal Golden Visa investment funds list

| Fund name | Economic sector | Subscription fee | Annual management fee | Maturity |

| Hungary | ||||

| SPRINT ASSET | Real estate, securities | €5,000 | 2.5% | 20 years |

| Gravitas | Real estate, bonds | €4,100 | 4% | Continuous (open-end fund) |

| Portugal | ||||

| ActiveCap Opportunities | Mixed | 2% | 2% | 10 years |

| Container Fund | Technology | 2% | 2% | 10 years |

| Finance Fund | Renewable energy | 1.5% | 1.5% | 10 years |

| FCR Hospitality Fund | Hospitality | 1% | 1.5% | 10 years |

| Growth Blue Fund | Blue Economy | 3% | 2% | 10 years |

| Iberian Net Zero | Renewable energy | 1% | 1.6% | 8 years |

| Indexed Fund | Securities | 2% | 2% | 10 years |

| Mercan Private Equity Fund | Hospitality | 0% | 0.25% | 12 years |

| Mercurio Fund | Mixed | 0% | 2% | 7 years |

| Pela Terra | Agricultural | 1% | 1.5% | 7 years |

| Portugal Gateway | Technology | 0% | 2% | 10 years |

| Portugal Golden Opportunities | Equities, bonds | 1% | 1.8% | Continuous (open-end fund) |

| Private Equity Fund | Venture capital | 0% | 1.5% | 10 years |

How to obtain residency by purchasing fund units?

The overall process of securing residency through fund investment in Hungary and Portugal is relatively straightforward, although the timeline and certain requirements differ.

According to Olivia Morgan, obtaining a Hungary Golden Visa usually takes at least 5 months, while securing a Portugal Golden Visa requires a minimum of 12 months.

-

1 dayPreliminary check

At the initial stage, it is recommended to carry out a background check before starting to prepare documents for Hungary or Portugal. This confidential screening is usually completed within one day and requires only a valid passport.

Preliminary check -

Up to 2 monthsPreparing documents

Applicants receive a detailed list of the documents needed for the residency application. Support is usually provided with translations, notarisation, and completion of the necessary forms to ensure they meet the legal requirements of each country.

For the Portugal Golden Visa, this stage also includes obtaining a tax number, opening a bank account, and in some cases travelling to Portugal.

For the Hungary Golden Visa, applicants who do not qualify for visa-free entry obtain a Guest Investor Visa to enter the country.

Preparing documents -

Up to 3 monthsInvesting

Applicants then purchase units in the selected investment fund. The required supporting documents confirming the investment are prepared and submitted as part of the application.

For the Hungary Golden Visa, the investment must be completed after the applicant arrives in Hungary. For the Portugal Golden Visa, this step can be completed remotely[3].

Investing -

1 dayApplying for residency

Applications for residency are submitted online through the official government portals, together with electronic copies of the required documents.

Applying for residency -

Up to 10 monthsReceiving a residence permit

Applicants must provide biometric data before their residence permit cards are issued. During this appointment, they also present the original documents.

In Hungary, residence permit cards are delivered directly to the investor’s address. In Portugal, cards can be collected either in person by the investor or by a representative acting under a power of attorney.

Receiving a residence permit

What are the key benefits of obtaining Hungary or Portugal residency through fund investment?

Residency by investing in approved funds in Hungary or Portugal offers a range of practical advantages. This route is fully passive, requires no relocation, and provides a secure pathway to long-term residence in an EU country while keeping administrative requirements to a minimum.

1. Visa-free travel across 29 European countries

Hungary and Portugal are part of the Schengen Area[4], allowing their residents to travel freely across member countries without additional visas for up to 90 days in any 180-day period.

2. Option to relocate to an EU country

Both countries offer a straightforward route to European Union residency. This grants the right to live, work, study, run a business, and access public healthcare and education across the country where residency is obtained.

For Golden Visa holders, relocation is voluntary, not mandatory.

3. Business and investment opportunities

Residency in Hungary or Portugal provides access to the EU single market, one of the world’s largest economic zones. Investors can expand their businesses across Europe, benefit from EU trade agreements, and reach a wide consumer base.

Hungary also has a notable advantage: the lowest corporate profit tax in the EU at a 9% rate.

4. Access to quality healthcare and education

Residents of Hungary or Portugal may use well-developed public healthcare systems offering high standards of care at affordable rates.

Both countries also provide strong education systems. Portugal hosts several universities highly ranked in Europe, while Hungary offers reputable institutions with comparatively lower tuition fees.

5. Potential pathway to citizenship

Residency obtained through fund investment can lead to citizenship in both countries. Portugal allows eligible residents to apply for citizenship after 5 years. Hungary also provides a route to citizenship, though the requirements are stricter and the overall timeline is 6 years longer than in Portugal and makes 11 years in total[5].

Citizenship in either country grants full EU membership benefits, including wider travel opportunities.

Prospect of citizenship after Hungary and Portugal Golden Visas

Hungary and Portugal offer a route to citizenship through their Golden Visa programs, although the timelines and residency obligations differ markedly. Both countries require applicants to demonstrate knowledge of the national language.

In Hungary, investors may apply for permanent residency after 3 years of living in the country. To qualify, they must spend at least 27 out of 36 months in Hungary and cannot be absent for more than 4 consecutive months.

Citizenship is available only after holding permanent residency for a further 8 years, making the full period 11 years. During this stage, absences are limited to 6 consecutive months or 2 years with prior approval.

In Portugal, investors may apply for citizenship after 5 years of residency, without first obtaining a permanent residence permit. Maintaining residency requires a stay of only 7 days per year.

Which fund and residency should you choose?

Hungary and Portugal both provide residency by investment in fund units, yet the programs differ in cost, processing times and long-term outcomes.

In Hungary, the minimum investment is €250,000, making it a more accessible option. The procedure is also faster, with residency typically granted in around 5 months. Portugal Golden Visa requires €500,000, and the process generally takes 12 months.

In Portugal, however, eligible applicants may apply for citizenship after 5 years, while the full timeline in Hungary extends to 11 years. Portuguese funds also tend to offer higher potential returns, with yields of up to 20% per year, compared with the more modest annual returns of Hungarian funds, which usually stand at only a few percentage points.

In summary, Hungary is well suited to investors seeking a more affordable and faster path to residency. Portugal, by contrast, is better for those prioritising higher investment returns and a shorter route to EU citizenship, without the need to relocate.

Sources

- Source: Residence permit for guest investor, National Directorate-General for Aliens Policing

- Source: Autorização de Residência para Investimento, Art. 90.º A AIMA

- Source: Corporate income tax, Hungarian National Tax and Customs Administration

- Source: Guest investor visa and permit, FAQ, OIF

- Source: Schengen Area, European Commission

- Source: Naturalisation, Embassy of Hungary